The Simple Path to Wealth by J L Collins Summary

Transform your finances with "The Simple Path to Wealth" - the FIRE movement's bible with 23,000+ five-star reviews. Endorsed by Mr. Money Mustache and Mad Fientist, Collins demystifies investing with casual brilliance. What's the simple secret that's hiding your financial freedom?

About the author

J L Collins is the international bestselling author of The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life, celebrated as a foundational voice in the financial independence movement.

With a background spanning roles as a talk show host, magazine publisher, and founder of the Chautauqua financial independence retreats, Collins distills decades of investing wisdom into accessible strategies centered on index funds, frugality, and long-term wealth building.

His expertise grew from a personal blog, jlcollinsnh.com, initially created to document lessons for his daughter, which evolved into the influential Stock Series and a viral Talk at Google with over 1.4 million views.

Collins’s other works include How I Lost Money in Real Estate Before It Was Fashionable (2021) and Pathfinders (2023), which expands on real-world journeys to financial freedom. The Simple Path to Wealth has sold more than 400,000 copies, solidifying its status as a definitive guide for investors seeking simplicity and clarity.

FAQs About This Book

The Simple Path to Wealth outlines a 3-step strategy for financial independence: spend less than you earn, avoid debt, and invest surplus income in low-cost index funds. J.L. Collins emphasizes building "F-You Money" to gain freedom from traditional employment, using compounding growth to achieve long-term wealth. The book originated as letters to his daughter, distilling decades of financial wisdom into actionable advice.

This book is ideal for beginners seeking a no-nonsense approach to personal finance and experienced investors valuing simplicity. It’s particularly relevant for those overwhelmed by complex investment strategies, individuals aiming for early retirement, or parents teaching financial literacy. Collins’ relatable anecdotes and aversion to financial jargon make it accessible to all.

Yes, with over 400,000 copies sold and endorsements from the FIRE (Financial Independence, Retire Early) community, the book remains a timeless guide. Its principles—like index fund investing and debt avoidance—are market-agnostic, making it relevant despite economic shifts. Readers praise its practicality, with one calling it “the Rich Dad Poor Dad for index fund investors.”

Collins’ core principles are:

- Spend less than you earn to create investable surplus.

- Avoid debt, which he likens to “slavery” due to interest and lost opportunity costs.

- Invest in VTSAX (Vanguard’s Total Stock Market Index Fund) for long-term growth.

These steps aim to build “F-You Money,” allowing withdrawal rates of 4% annually for financial independence.

“F-You Money” refers to savings that grant freedom to leave unfulfilling jobs or toxic relationships. Collins argues financial independence is life’s ultimate luxury, enabling choices aligned with personal values. This concept underscores the book’s thesis: money’s primary purpose is to buy autonomy, not material possessions.

Collins advocates investing 100% of surplus income into low-cost index funds like VTSAX, which tracks the entire U.S. stock market. He rejects stock-picking, market timing, and actively managed funds, citing studies where index funds outperform 80-90% of professional investors over time. This passive strategy minimizes fees and emotional decision-making.

Collins views debt as a wealth-destroying force due to compounding interest and lost investment opportunities. He compares debtors to “gilded slaves” tethered to creditors or employers, using Mike Tyson’s $300 million bankruptcy as a cautionary tale. The book urges prioritizing debt repayment before investing.

The 4% rule states that withdrawing 4% annually from a diversified portfolio ensures lifelong financial independence. For example, a $1 million portfolio allows $40,000/year withdrawals. Collins highlights this as a safeguard against market volatility, provided investors maintain discipline during downturns.

A former publisher and blogger, Collins’ English literature degree shapes his clear, narrative-driven style. His 40+ years of investing—including real estate failures—inform the book’s pragmatic tone. Dubbed the “Godfather of FI,” he co-founded the Chautauqua retreats, cementing his role in the financial independence movement.

Unlike Rich Dad Poor Dad (entrepreneurship-focused) or The Intelligent Investor (value investing), Collins’ book prioritizes simplicity. It avoids real estate or side hustles, instead advocating index funds as the sole wealth-building tool. This makes it ideal for passive investors seeking minimal effort.

- “Your freedom is the most important thing your money can buy.”

- “Debt is the antithesis of freedom.”

- “The stock market is the only market where things go on sale and everyone gets scared.”

These quotes encapsulate the book’s themes of autonomy, debt aversion, and disciplined investing.

Critics argue the book oversimplifies (e.g., ignoring international diversification) and underestimates debt’s utility (e.g., mortgages for real estate). Some find its anti-advisor stance risky for financially illiterate readers. However, supporters counter that its simplicity is its greatest strength.

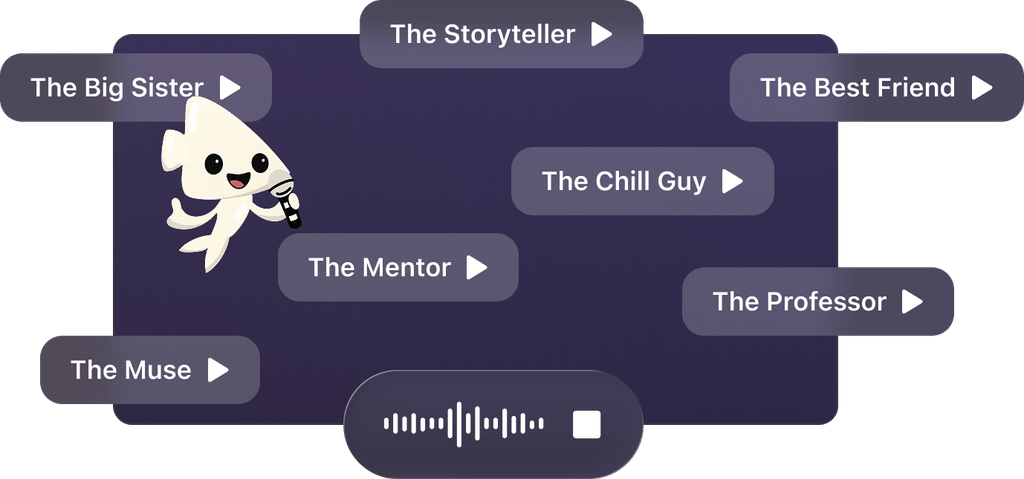

Quick Summary Mode - Read or listen to The Simple Path to Wealth Summary in 8 Minutes

Break down key ideas from The Simple Path to Wealth into bite-sized takeaways to understand how innovative teams create, collaborate, and grow.

Flash Card Mode - Top 11 Insights from The Simple Path to Wealth in a Nutshell

Distill The Simple Path to Wealth into rapid-fire memory cues that highlight Pixar’s principles of candor, teamwork, and creative resilience.

Fun Mode - The Simple Path to Wealth Lessons Told Through 18-Min Stories

Experience The Simple Path to Wealth through vivid storytelling that turns Pixar’s innovation lessons into moments you’ll remember and apply.

Personalize Mode - Read or listen to The Simple Path to Wealth Summary in 0 Minutes

Ask anything, pick the voice, and co-create insights that truly resonate with you.

From Columbia University alumni built in San Francisco

See More Stories?

Get the The Simple Path to Wealth summary as a free PDF or EPUB. Print it or read offline anytime.