Digital Bank by Chris Skinner Summary

In "Digital Bank," Chris Skinner - hailed as "one of the most brilliant minds in banking" - reveals how traditional banks must transform or die. Discover why fintech leaders consider this the blueprint for banking's digital revolution that's reshaping our financial future.

Users also liked

About the author

Chris Skinner, author of Digital Bank, is a globally recognized fintech expert and independent commentator on financial markets, renowned for his insights into digital transformation in banking. A bestselling author and keynote speaker, Skinner blends decades of industry analysis with hands-on advisory roles for institutions like HSBC, Citibank, and the World Economic Forum.

Digital Bank—a seminal work in fintech and banking strategy—explores the shift to digital-first financial services, drawing from Skinner’s leadership as CEO of The Finanser Ltd and Chair of the Financial Services Club, a think tank he founded in 2004.

His acclaimed blog, The Finanser, and follow-up books like Digital Human and ValueWeb further cement his authority on blockchain, AI, and the internet of value. Skinner frequently contributes to BBC News, Bloomberg, and CNBC, and his frameworks guide Fortune 500 companies and policymakers.

Recognized among the Wall Street Journal’s Top 40 Fintech Influencers, he advises 11:FS and Nordic Future Innovation. Digital Bank has become a cornerstone text for banking leaders, praised for its actionable strategies in an era of disruptive innovation.

FAQs About This Book

Digital Bank examines the transformation of banking in the digital age, emphasizing the shift from traditional branch models to customer-centric, data-driven strategies. Chris Skinner analyzes challenges like fintech disruption and mobile-first consumers, offering actionable frameworks for banks to adopt modular services, predictive analytics, and secure digital ecosystems. The book highlights the urgency for legacy institutions to innovate or risk obsolescence.

Financial professionals, fintech innovators, banking executives, and students of finance will benefit from Skinner’s insights. It’s particularly valuable for digital strategists seeking to understand mobile banking trends, data monetization, and customer experience redesign. The book also appeals to policymakers studying the regulatory implications of digital finance.

Yes. Skinner combines decades of industry expertise with interviews from fintech leaders, offering a balanced mix of theory and practice. The book’s focus on real-world case studies—like transitioning to cloud-based systems—makes it a vital resource for navigating digital disruption.

- Digital-first mindset: Banks must prioritize electronic channels over physical branches.

- Data as currency: Leverage analytics for personalized services and fraud detection.

- Customer context: Shift from “Know Your Customer” to understanding behavior patterns.

- Modular banking: Allow customers to customize services via APIs and apps.

A digital bank operates primarily through mobile and online platforms, with physical branches as supplements. It uses data to predict needs (e.g., cash-flow alerts), offers modular services (e.g., customizable apps), and maintains 24/7 connectivity. Security and trust in data handling are foundational.

Data is the “new money,” enabling predictive marketing, risk management, and hyper-personalized products. Skinner argues that banks failing to treat data as a core asset will lose to agile fintechs. He also stresses balancing innovation with GDPR-like privacy safeguards.

- “Banking is just bits and bytes”: Highlights the industry’s shift from cash to data transactions.

- “Data is the new money”: Emphasizes data’s role in competitive differentiation.

- “Banks must become invisible”: Advocates for seamless financial integration into daily life.

- Phase out legacy systems in favor of cloud-based infrastructure.

- Invest in AI and blockchain for real-time payments and smart contracts.

- Adopt open banking APIs to enable third-party service integration.

- Train staff to pivot from transactional roles to data-driven advisory.

Skinner envisions banks as embedded finance platforms within apps, social networks, and IoT devices. He predicts winners will use AI for proactive financial advice (e.g., auto-saving during income spikes) and tokenization for asset liquidity.

Some argue it underestimates regulatory hurdles and legacy banks’ inertia in adopting disruptive tech. Others note limited discussion on ethical AI use or income inequality in digital finance.

Unlike theoretical works, Skinner provides actionable steps (e.g., API roadmaps) and interviews with innovators like 11:FS. It complements The Digital Person by focusing on banking-specific privacy challenges.

With AI-driven neobanks and central bank digital currencies (CBDCs) dominating headlines, Skinner’s emphasis on agility and customer-centric design remains critical. The book’s cloud-first principles align with 2025’s hybrid banking models.

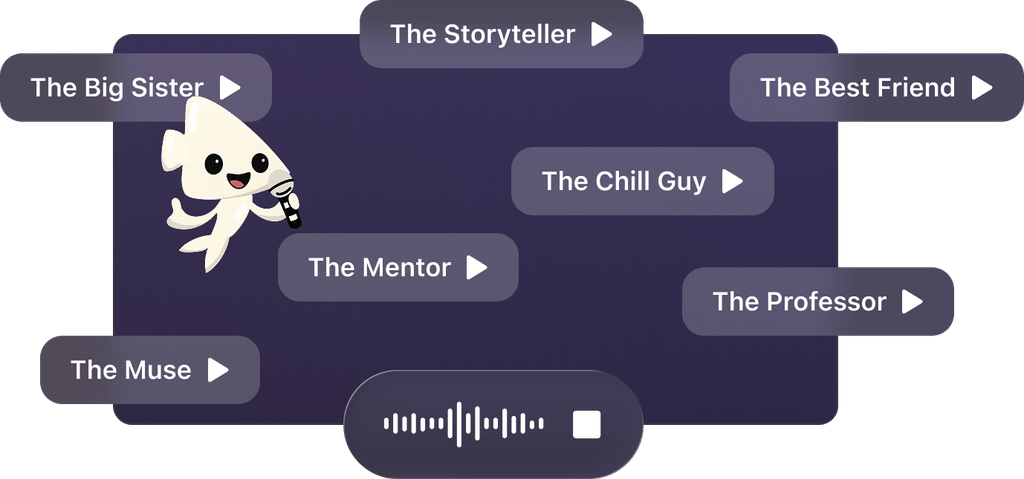

Quick Summary Mode - Read or listen to Digital Bank Summary in 9 Minutes

Break down key ideas from Digital Bank into bite-sized takeaways to understand how innovative teams create, collaborate, and grow.

Flash Card Mode - Top 10 Insights from Digital Bank in a Nutshell

Distill Digital Bank into rapid-fire memory cues that highlight Pixar’s principles of candor, teamwork, and creative resilience.

Fun Mode - Digital Bank Lessons Told Through 25-Min Stories

Experience Digital Bank through vivid storytelling that turns Pixar’s innovation lessons into moments you’ll remember and apply.

Personalize Mode - Read or listen to Digital Bank Summary in 0 Minutes

Ask anything, pick the voice, and co-create insights that truly resonate with you.

From Columbia University alumni built in San Francisco

See More Stories?

Get the Digital Bank summary as a free PDF or EPUB. Print it or read offline anytime.